straight life policy cash value

To be able to pay some of her medical bills. The 20000 that remains will be collected by the insurance company.

The Complete Resource For Straight Whole Life Insurance

Its been used for centuries to grow and protect policyholders moneyand not just by the wealthy.

. Decreasing term insurance is a type of annual renewable term life insurance that provides a death benefit that decreases at a predetermined rate over the life of the policy. In this case the death benefit increases as the cash value does. In return you receive a death benefit that is guaranteed.

Ad Cash in your life insurance policy. Another asset of a straight life policy is a cash value account. The cash value is an interest-earning account inside of your straight life insurance policy.

2 days agoLoans are available on life insurance policies when there is enough cash value. The cash value of a straight life policy grows like one. Also known as whole life insurance a straight life policy has a cash value account that grows in size as you contribute premiums.

Universal life insurance is a type of. Also known as whole life insurance a straight life policy has a cash. A straight life insurance policy can also build cash value over time.

Every time you pay your premium a portion goes towards maintaining your life insurance policy and the rest. It usually develops cash value by the end. Variable life insurance is a type of permanent life insurance with a cash value and with investment options that work like a mutual fund.

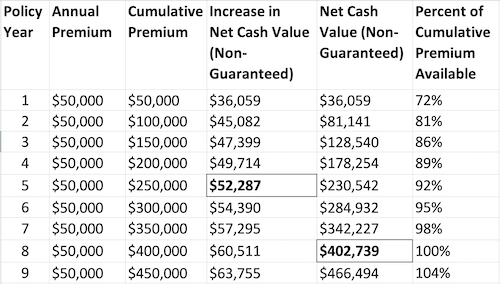

Which of the following could be a future use of cash value that builds in a recently-purchased whole life insurance policy. Convert the cash value to a paid-up term policy. Straight whole life insurance require more premium than term life insurance policies for the same death benefit in the early years of a policy and less premium than term life insurance in later.

Straight life insurance is a policy that provides lifelong life insurance coverage with continuous level premium payments. This death benefit equals the cash value plus the death benefit your policy was issued with. It also gives policyholders the ability to take advantage of outside investment opportunities through policy loans.

A straight life insurance policy is one of the oldest types of insurance. Call 847 403-8569. Straight life insurance is a policy that provides lifelong life insurance coverage with continuous level premium payments.

Also known as whole life insurance a straight life policy has a cash. The amount you can borrow is represented as a percentage of the cash value. We offer a life insurance settlement calculator to provide our clients with a clear.

Its premium steadily decreases over time in response to its growing cash value. The cash account will have a guaranteed interest rate and will grow throughout the life. Which statement is NOT true regarding a Straight Life policy.

Single premium life insurance SPL is a type of policy that can be fully funded in a single payment. A life insurance policys average surrender value is 460 for every 100000 in face value.

Should I Cancel My Whole Life Insurance Policy White Coat Investor

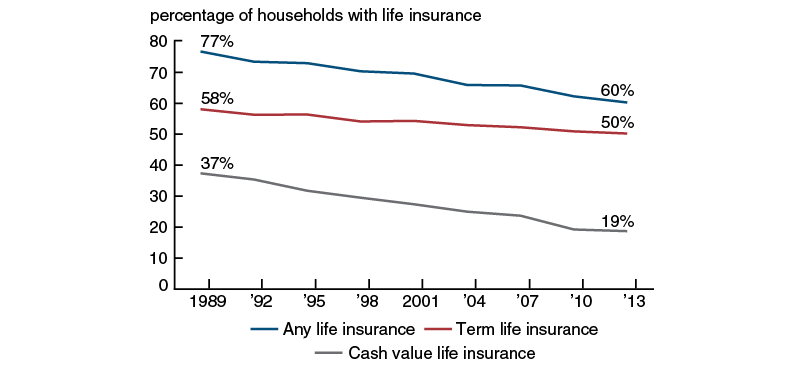

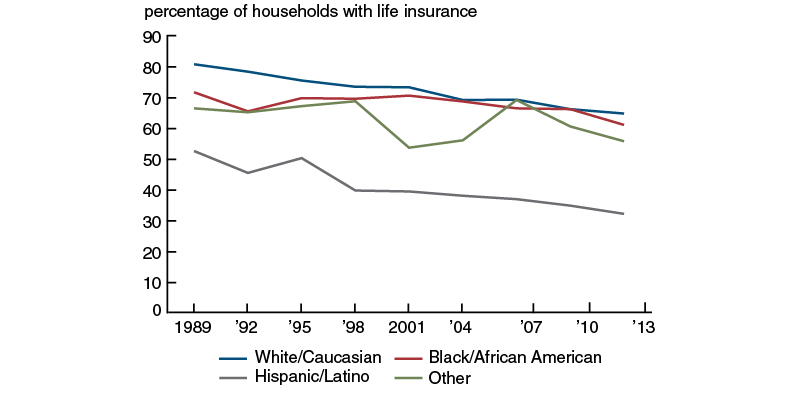

What Explains The Decline In Life Insurance Ownership Federal Reserve Bank Of Chicago

What Are Paid Up Additions Pua In Life Insurance

Annuity Payout Options Immediate Vs Deferred Annuities

Straight Life Insurance New York Life

7 Lies About Whole Life Is Whole Life A Good Investment 2020

What Are Paid Up Additions Pua In Life Insurance

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Straight Line Depreciation Method

The 7 Types Of Life Insurance Policies What S The Best One For You

High Cash Value Life Insurance And Long Term Growth Whole Life

Is A Straight Life Policy Right For Me Paradigmlife Net Blog

Should I Cancel My Whole Life Insurance Policy White Coat Investor

Is A Straight Life Insurance Policy Right For You Wealth Nation

The Risks Of Cash Value Life Insurance

:max_bytes(150000):strip_icc()/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

What Explains The Decline In Life Insurance Ownership Federal Reserve Bank Of Chicago

What Is Straight Life Insurance Valuepenguin

What Is Single Premium Life Insurance The Pros And Cons Valuepenguin